When You begin serious about your retirement, It is simple to feel overwhelmed by the sheer number of selections you might want to make. From assessing your recent fiscal status to choosing the right retirement accounts, Each individual action is important in building a protected long run. You've very likely viewed as how inflation could erode your discounts or even the impact of unexpected healthcare expenditures. But have you considered how adjustments in market ailments or your personal situation could have an effect on your long-phrase plans? Let's examine how typical assessments and adjustments to the retirement strategy can hold you on track, it doesn't matter what everyday living throws your way.

Just before diving in the complexities of retirement planning, it is important To guage in which you now stand financially. Begin with a thorough funds analysis. You might want to grasp just how much you are shelling out as opposed to exactly how much you're earning. This suggests tracking every single price—Irrespective of how small—and evaluating it to your total income. Comprehending your money movement is crucial in evaluating your financial health.

Next, perform an asset evaluation. Checklist all your belongings—discounts accounts, stocks, property, as well as other investments. It's significant to grasp not precisely what you very own, but also its present-day price. This will provide you with a transparent image of your prosperity and enable you to pinpoint areas That may require bolstering prior to deciding to retire.

Revenue analysis is an additional important action. Break down your sources of money. Will you be based on one source or many streams? Diversifying your earnings can lower risks and stabilize your fiscal future. Additionally, consider any prospective variations for your cash flow when you approach retirement.

Financial debt management can't be forgotten. Identify all your debts—from mortgages to credit cards. Large fascination fees can cripple your preserving efforts, so think about approaches to pay down substantial-Charge debts. Also, know how your credit card debt concentrations might affect your retirement ideas.

Reflect on your lifestyle concerns and financial savings routines. Have you been living within your means? Are you location aside sufficient for the future? Improving upon your economical literacy may help you make knowledgeable decisions and establish superior conserving methods.

Frequent price tracking and adjustment are necessary to guarantee you might be on the appropriate path to the secure retirement.

Understanding your retirement desires is important to making sure a comfortable and protected potential. It is really about a great deal more than just replacing your present-day cash flow; it involves an intensive look at Whatever you visualize to your retirement Life style and how Social Safety will Participate in a role in it.

1st, Examine what kind of Life-style you intention for in retirement. Do the thing is your self traveling extensively, or perhaps settling right into a tranquil Group? Every decision has distinctive financial implications. As an illustration, a globetrotting retirement could possibly need a larger nest egg than a simpler, much more localized Life-style.

Upcoming, take into consideration how Social Stability benefits will match into your strategy. Although these Rewards supply a simple security net, They are normally not ample to deal with all charges, particularly if you are aiming for any Way of life that's a move up from primary necessities.

Recall, the age at which you decide on to begin claiming Social Stability Positive aspects tremendously impacts the month-to-month payments you'll acquire. Delaying Positive aspects can improve your monthly checks, giving a lot more financial comfort and ease, or commencing before may very well be essential based upon your overall health and financial condition.

It is also essential to consider healthcare demands, as these costs might be a substantial burden for the duration of retirement. Think about Medicare or private insurance policies expenditures and probable out-of-pocket expenditures.

Immediately after assessing your retirement lifestyle and comprehending Social Safety's job, It can be important to set realistic economical plans that align together with your envisioned long term. You'll need to use goal-location procedures that think about your genuine wants, aspirations, and the truth of your fiscal problem.

Initially, evaluate your anticipated money sources, excluding opportunity earnings from retirement accounts, as All those might be protected later on. Consider how your existing cost savings and investments will translate into future revenue. Are these resources adequate to go over your projected expenses? If there is a shortfall, You'll have to regulate your conserving tactics now.

Next, define obvious economic milestones. These are definitely specific markers you aim to achieve at set occasions. For instance, by age 50, you could possibly concentrate on obtaining 6 times your once-a-year income saved. These milestones work as checkpoints to guarantee you are on speed to meet your retirement plans.

Use resources like retirement calculators to venture your discounts advancement and figure out the amount you should preserve monthly. This strategy aids you visualize the impression of conserving kind of and might modify your strategies accordingly.

Owning set your fiscal milestones, deciding on the appropriate retirement accounts becomes your subsequent vital action. Steering with the myriad options may be scary, but comprehending each account's Positive aspects will guide your choice-building approach.

Let's start with Particular person Retirement Accounts (IRAs). You've got two main styles: Roth IRA and Traditional IRA. A Roth IRA presents tax-absolutely free advancement and tax-free of charge withdrawals in retirement, rendering it a compelling choice in case you foresee getting in a higher tax bracket later. Conversely, a conventional IRA offers tax-deductible contributions and taxes are deferred right up until you withdraw funds through retirement, which could be advantageous in case you be expecting to be in a lessen tax bracket submit-retirement.

Next, look at your 401(k) choices, particularly when your employer offers a matching contribution. This will drastically boost your personal savings. Pay attention to the choice of expense selections inside of your 401(k), for example goal date cash, which automatically alter the asset mix when you in close proximity to retirement age.

You should not forget Well being Savings Accounts (HSAs) Should you have a large-deductible health system. HSAs offer you triple tax strengths: tax-deductible contributions, tax-cost-free advancement, and tax-free of charge withdrawals for capable health-related charges. In retirement, You should use these cash for general expenses without having penalty, Even though usual cash flow taxes implement.

Tax implications Engage in a substantial part in every one of these possibilities. Roth conversions and account rollovers will need cautious consideration to avoid unintended tax outcomes.

Also, expense diversification within these accounts is important to control danger and optimize returns eventually.

Even though picking the appropriate retirement accounts is a significant move in securing your economical future, It truly is Similarly important to reflect on how inflation could erode the worth of one's price savings as time passes. Being familiar with the inflation effect on your retirement cash is important to ensuring you may have sufficient to continue to exist as part of your later on decades.

Inflation, simply put, is the rate at which the overall level of rates for products and products and services rises, and subsequently, obtaining electrical power falls. When your retirement financial savings Do not mature in a charge that outpaces inflation, you will discover that your cash obtain a lot less and less as time goes on. This is why incorporating personal savings approaches that account for inflation is essential.

A single successful tactic is To judge the historic common inflation price when preparing your cost savings aims. This charge has hovered about two-three% each year. By aiming to exceed this amount within your personal savings advancement, you will website help maintain the buying electrical power of one's retirement funds.

On top of that, It really is smart to on a regular basis evaluate and modify your savings prepare. As inflation fluctuates, you could possibly really need to raise your contributions to compensate.

Diversifying your cost savings might also aid take care of the risk of inflation. Although particular procedures will be reviewed afterwards, knowing that not all discounts motor vehicles are Similarly liable to inflation is significant.

For instance, common financial savings accounts mightn't produce sufficient to surpass inflation, making them considerably less powerful as extended-phrase techniques.

Expenditure approaches that foster expansion are fundamental while you navigate the complexities of building a strong retirement fund. While you discover the myriad options out there, understanding the strength of asset allocation and diversification tactics gets major.

These strategies are not just about spreading your investments; They are about optimizing your portfolio to reinforce potential returns whilst aligning with the extensive-phrase retirement aims.

Asset allocation involves dividing your investments among the various categories such as stocks, bonds, and real estate property. This isn't a one-dimensions-matches-all method. You'll have to regulate your allocation dependant on your age, threat tolerance, and financial targets.

When you get closer to retirement, you may lean towards a lot more conservative investments. Nonetheless, it's important to keep up a portion in advancement-oriented property to ensure your portfolio carries on to improve and outpace inflation.

Diversification methods take asset allocation a move even more by spreading your investments within just Just about every asset classification. This implies not just investing in stocks, but in many different sectors and geographies.

This technique allows lower danger and can result in more stable returns. It's like putting your eggs in several baskets. If 1 basket encounters an issue, your All round portfolio can continue to accomplish nicely as a result of toughness in the Many others.

Taking care of danger is critical in retirement arranging since it allows you protect your prosperity and sustain money balance into your later on decades. As you method retirement, the focus generally shifts from prosperity accumulation to wealth preservation. Understanding and taking care of hazards, especially longevity possibility—the chance of outliving your price savings—gets vital.

You have probably listened to about diversification strategies, but you may not entirely understand their worth in mitigating danger as you age. Diversification is just not just about mixing stocks and bonds; it includes spreading your investments across many asset courses, including real-estate And perhaps commodities, to lessen the impact of volatility. Every single asset class reacts otherwise to industry conditions, as well as a effectively-diversified portfolio might help smooth out returns and shield your money.

An additional facet of hazard administration in retirement scheduling is recognizing the impact of sequence of returns threat. This threat occurs when the marketplace encounters considerable downturns equally as you start to withdraw funds in retirement. Negative returns early in retirement can deplete your portfolio extra immediately than if the identical returns transpired afterwards. To control this, you may take into consideration methods like maintaining a dollars reserve or structuring withdrawals additional strategically.

Last of all, don't ignore inflation hazard. Over time, inflation can erode your purchasing ability, which makes it more difficult to maintain your Way of living. Which include assets with probable for appreciation or money that adjusts for inflation may be valuable.

One critical facet of retirement planning is preparing for healthcare costs, which might quickly grow to be a big economic burden while you age. Understanding and running these charges are vital to keeping your financial wellness through retirement.

Very first, check out healthcare insurance possibilities available for retirees. Classic Medicare handles numerous standard health wants, but You will likely will need additional protection for areas like prescription drug expenses and prolonged-phrase care. Medigap and Medicare Advantage plans can provide broader coverage, so it is important to compare these Medicare alternatives thoroughly to seek out what best suits your needs.

Investing in a retirement healthcare savings account, for instance a Health and fitness Savings Account (HSA), is usually a intelligent go. Money in these accounts expand tax-free and will be withdrawn tax-totally free for capable health-related costs, giving a buffer towards long run Health care expenditures. You must improve your contributions even though you are still Doing work to enjoy the utmost Advantages.

Serious ailment organizing is an additional essential component. With the chance of establishing chronic problems rising while you age, using a system in spot for these kinds of potentialities is elementary. This may entail placing aside additional funds or making certain that the Health care insurance coverage consists of suitable protection for these circumstances.

Also, Never forget the value of wellness courses. These systems usually lead to higher very long-time period health and fitness outcomes and may also help cut down healthcare expenditures by stopping illnesses right before they begin.

Immediately after confirming your Health care wants are tackled, you are going to also ought to ponder how to manage your assets and legal affairs by means of estate planning and can planning.

It truly is vital to know how believe in provisions can safeguard your assets in the probate process, probably reducing estate taxes and guaranteeing smoother asset distribution between your beneficiaries.

Incorporating trust provisions enables you to specify disorders on how and Once your assets is going to be dispersed, which may be significant in avoiding will contests from disgruntled kinfolk.

Likewise, obvious beneficiary designations are fundamental to determine your assets are handed to the correct people with out authorized complications. This features not only key belongings like houses or bank accounts and also electronic property, which are usually forgotten.

Yet another substantial part is the inclusion of Health care directives within just your estate scheduling. These directives ensure that the Health care Choices are respected, Even though you're unable to communicate them.

Along with this, guardianship issues really should be dealt with if you have dependents, making certain they're cared for by folks you belief as part of your absence.

Though charitable providing is usually a rewarding addition towards your estate plan, it is important to framework these items To optimize their influence and gain each the receiver as well as your estate.

As your life situation improve, it's essential to overview and regulate your retirement plan to ensure it stays aligned together with your present-day needs and targets. Over time, numerous aspects which include sector volatility, tax implications, and Life-style modifications necessitate a new have a look at how you're managing your investments and savings.

It isn't pretty much tweaking numbers; it's about guaranteeing your fiscal security as you move nearer to retirement age.

Let's take a look at the necessity of understanding market volatility and its impact on your retirement price savings. As marketplaces ebb and stream, the value of your investments can fluctuate markedly. Regular reviews allow you to regulate your asset allocation to raised match your danger tolerance and retirement timeline.

This might suggest shifting from shares to bonds or altering your portfolio to include far more secure, a lot less volatile investments as you close to retirement.

Tax implications are A different substantial component that may affect your retirement scheduling. Changes in tax rules could impression the efficiency of one's present withdrawal procedures and necessitate adjustments to optimize tax Added benefits.

It is also a good idea to mirror on how your retirement money—which include withdrawals from a retirement accounts and Social Security Gains—might be taxed to stay away from any disagreeable surprises.

What's more, Way of living adjustments for example marriage, divorce, or the necessity for spouse and children aid can redefine your financial responsibilities and targets. Unpredicted charges, like health care expenses or household repairs, may also derail your retirement price savings Otherwise accounted for.

Therefore, It truly is crucial to incorporate overall flexibility into your retirement program to accommodate both foreseen and unexpected variations.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Freddie Prinze Jr. Then & Now!

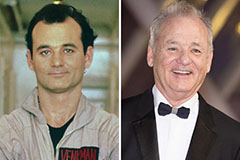

Freddie Prinze Jr. Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!